Malaysia's Trusted AI for Bank Statement Analysis

Powered by in house technology. Processed over 100,000 statements. Serving 5 enterprise clients and one local bank.

Our Technology

Statement Parsing

We have parsed and analyzed over 100,000 statements from Malaysian banks, including bank statement, credit card and eWallet statements.

Machine Learning Model

We have developed our categorization and enrichment machine learning models trained on over 800k unique transaction data points.

Our advanced tech infrastructure is designed in accordance with ISO 27001 standards to ensure the highest level of security.

Industry Standard Security

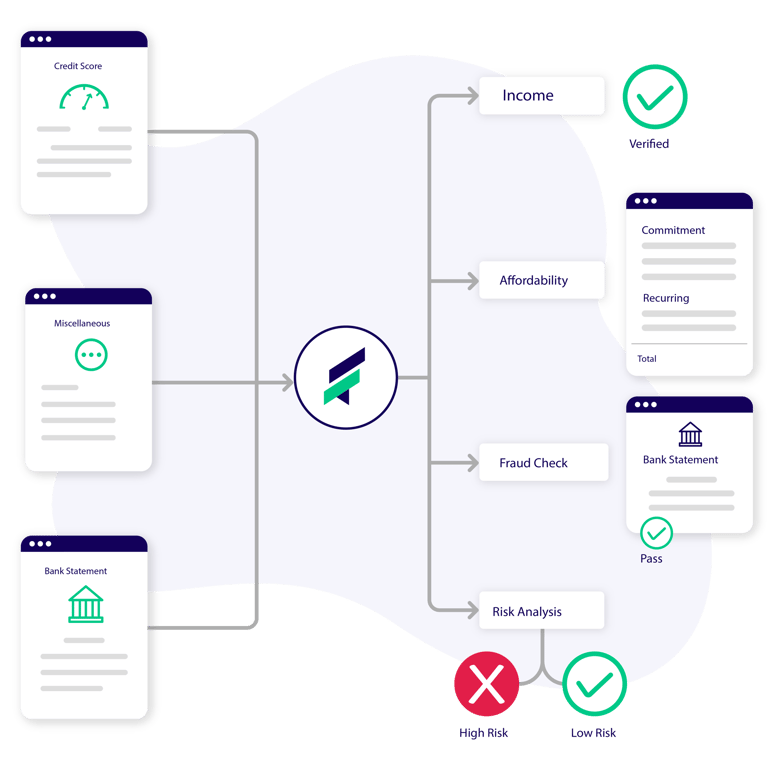

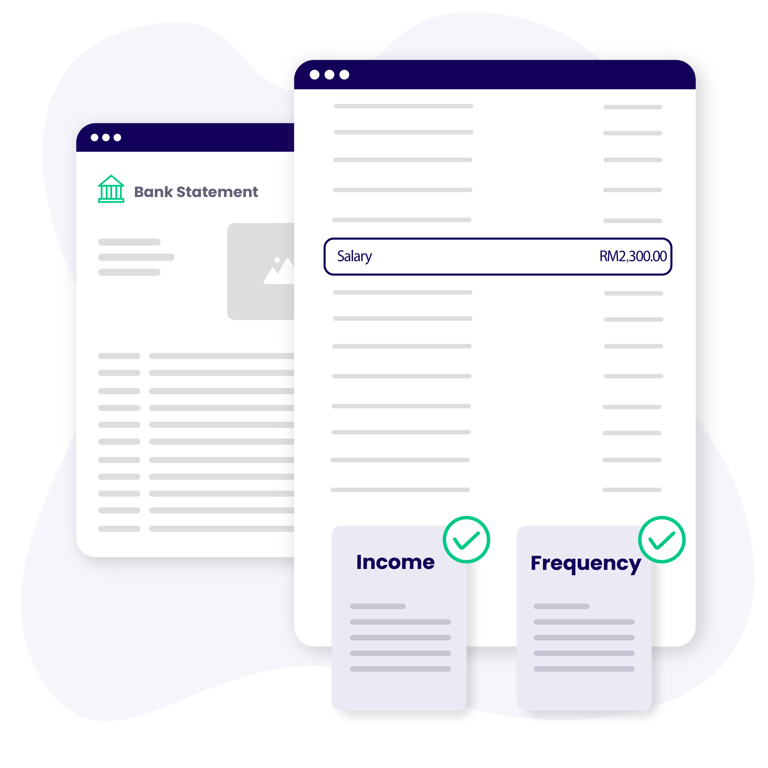

Income Verification

Enhance your understanding of your customers' income by utilizing our precise data science algorithms. Increase your awareness of their financial standing and capacity to make payments.

Our Features

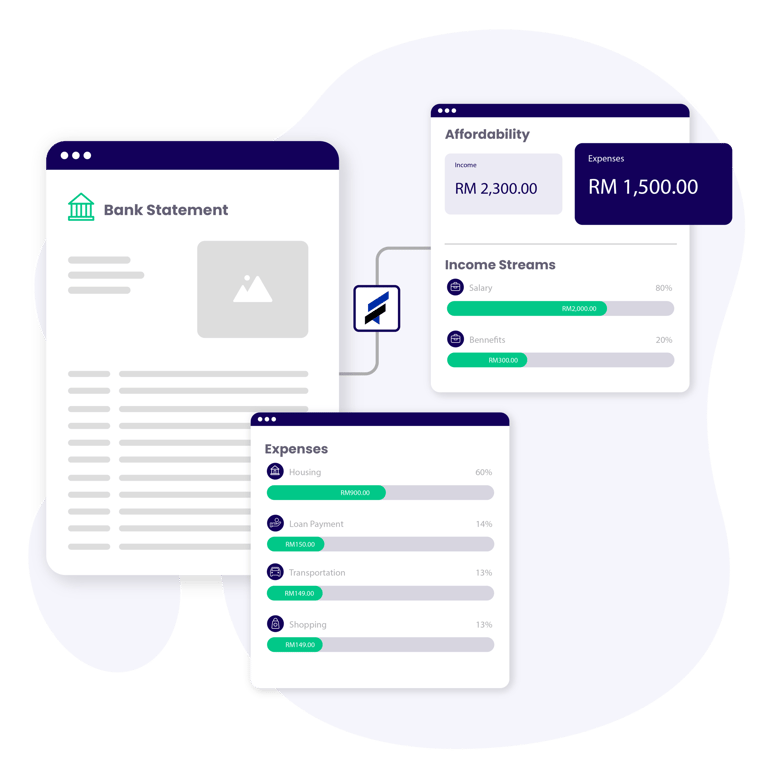

Affordability Assessment

Understand your customer's finances better by looking at how much money they currently earn and what their monthly expenses are, to get a clearer picture of their financial situation.

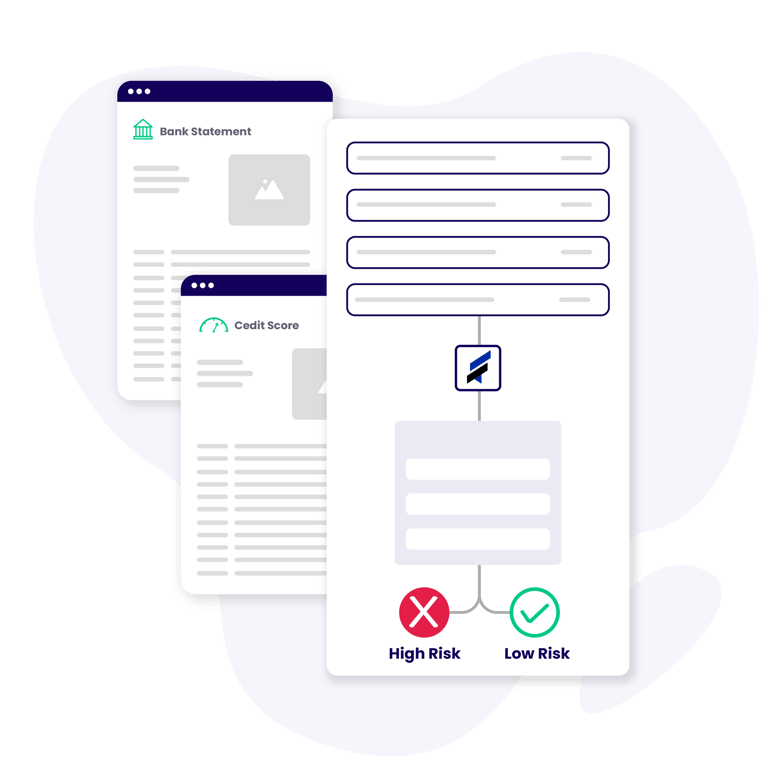

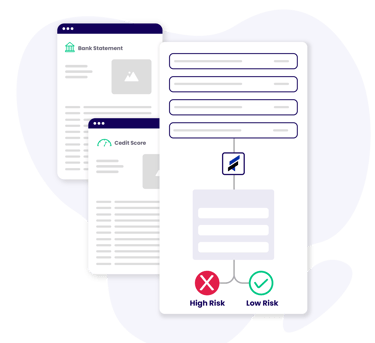

Financial Credibility

Our financial credibility is powered by AI technology that merges the user's credit report and enriched financial data obtained from their bank statements. This allows us to analyze the user's profile and provide a risk assessment and creditworthiness based on the collected information.

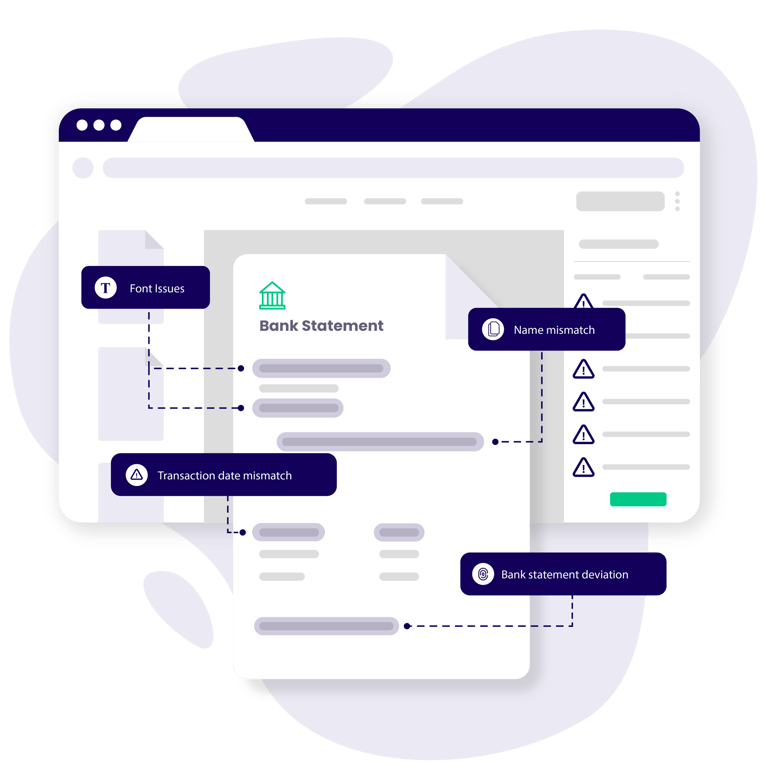

Fraud Detection

Detect fraudulent financial statement alterations that are not apparent to the naked eye and accurately determine the modifications made to a document.

HOW WE DO IT

EXTRACT SMARTLY

Our parsing technology allows us to extract all information from documents seamlessly.

DATA CLASSIFICATION

With our ML models, we are able to categorize the transactions of the borrowers.

DATA ENRICHMENT

Further understanding of logic can be implemented to the categorized transactions.

Integrations

Web Dashboard

Use our web dashboard to upload the borrower's bank statement and get the result.

Robust API

Embedded

Integrate our API into your existing processes and systems in the way you want it.

Seamlessly integrate into your current system with our embedded web component.

Easy and Fast Integration

Integrate Finory's proprietary AI engine to achieve >95% accurate transaction categorization. Secure data parsing and normalization for enterprise applications and regulatory compliance.

Deployment

On Premise

Use our web dashboard to upload the borrower's bank statement and get the result.

On Cloud

On SaaS

Integrate our API into your existing processes and systems in the way you want it.

Seamlessly integrate into your current system with our embedded web component.

Documents We Support:

All Malaysian bank statements, credit card statements, eWallet statements, payslips, EPF statements, and more.

The Future Of Financial Services

Help your customers to better manage their money by embedding financial management features in your app.

Personal Finance Management

Personal Loan Assessment

Your customer doesn't have to wait anymore. Provide instant results of loan applications.

OCR Solutions

Get structured data from bank statements, financial documents, payslips, and EPF statements through our OCR solution.

SME Business Loan Assessment

Save time and reduce errors while evaluating business loan applications through humans.

Learn more >

Learn more >

Learn more >

Learn more >

Finory.tech provides B2B API solutions for financial institutions. Instantly analyze and categorize bank statements for automated underwriting, fraud detection, and risk assessment.

You didn’t come this far to stop.